Special Opportunities

Our Special Opportunities strategy is a short duration portfolio of loans seeking to minimize both interest rate risk and credit risk, targeting three primary verticals.

Litigation Finance:

The practice of an independent party providing capital to fully or partially fund litigation in return for a portion of any monetary recovery.

Life Settlements

Low Correlation

The asset class historically has lower exposure to economic and financial market cycles.

Attractive Expected Returns

Potential for high yield returns relative to investment grade fixed income.

High Credit Quality

Insurance carrier's credit is typically investment grade and insurance policies remain a senior obligation.

Expanding Regulated Market

The life settlements market has continued to grow - estimates of the overall market range from an estimated $240 to $600 billion of policy benefits.

Specialty Credit

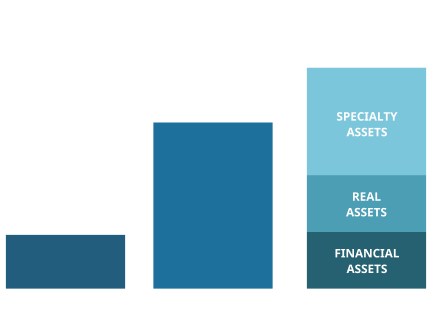

Opportunistic investments targeting short duration, high yield returns across Specialty Assets, Financial Assets, and Real Assets.

Request Fact Sheet

For more information on our Special Opportunities strategy, request our fact sheet below.